|

1. Distributing of Personal Property

The personal property should be distributed per the decedent’s will or by the Personal Representative. But sometimes, friends or relatives help themselves to personal possessions even though there was no authority to take any of the personal property – this can occur prior to the appointment of a PR. I highly recommend that the heirs/PR engage a professional early to facilitate the process. Otherwise, the heirs should work together to distribute the personal property equitably - although this can be an extremely difficult task. Once all of the personal property has been distributed and there are items of value that remain, it is a good time to involve professionals to assist in the liquidation of the remaining assets. Often, there is little or no value of the remaining items. There are specialized businesses that can assist in this process.

2. Interviewing and hiring the right REALTOR or selling to a Cash Buyer

Once the heirs/PR have the authority and decide to sell, hiring the right REALTOR/company is critically important and can help determine the best strategy. If the property is not in good condition or if it is not in financeable condition, thought must be given to whether or not estate funds will be used to make repairs or improvements. Often the PR is not authorized to expend estate funds for this purpose. There are a few REALTORS/companies that specialize in selling estate homes and offer additional services. This type of company has special skills and a list of subcontractors that can make the life of a personal representative (or heirs) easier while maximizing the net proceeds. They have relationships with auction, cleaning, staging and home improvement companies and subcontractors who can help sell the remaining personal property, make arrangements to gift what is not sold and remove the rest of the unwanted items and prepare the home for marketing. These experienced agents also often have experience in selling less than perfect homes and have the knowledge and skills to obtain maximum value. The professional real estate agent may suggest the list price for the home and whether or not to sell it improved or as-is, but it is the heirs/PR that ultimately make the these important decisions.

3. Making improvements to an inherited home – Maybe not a good idea

A qualified REALTOR may recommend certain improvements to the property prior to marketing to maximize net proceeds. Before authorizing any improvement, the PR needs to consider whether he or she is authorized to spend estate assets to make such improvements – usually they are not. According to Paul Brigham, “As counterintuitive as it may seem, a Personal Representative needs to remember that unless the will provides otherwise, they have nothing to do with the real estate.” At a minimum, if the home is to be sold traditionally it will need to meet minimum financeable requirements (for an FHA loan the home must meet HUD’s minimum property standards for health and safety: no peeling paint, no loose handrails, all stairways must have handrails, working heating system, roof in good condition and no other safety issues). This strategy may or may not be the best way to proceed. Only after careful consideration, and consultation with an estate attorney should estate funds be used for this purpose.

4. Determining if you need cash quickly to settle an estate or to pay off debt

Sometimes, it may be best to sell the property in as-is condition for several reasons: The PR may not have the authority to expend estate funds for improvements, even if they do - it may be too time consuming to engage the contractors, get the appropriate permits, get the work completed and signed off by the town and liquidate the property – there may be an urgency to convert the equity into cash to pay off other outstanding debt.

5. Selling to Cash Buyer or Real Estate Investor

If the property is not in financeable condition it may be best to sell directly to a cash buyer or real estate investor. Benefits of selling as-is include: convert home to cash quickly, no oversight, no chance of spending more than you will get back on the upgrade/improvement. Other benefits may include, no real estate broker fee, no showings or signage, avoid stress of renegotiation after home inspection and no finance contingency or appraisals that come in below the agreed purchase price.

Risks when selling an inherited home in Massachusetts

Personal representatives, heirs or trustees should be careful not to hold on to a property for too long. The risk for vandalism and other damage increases as a home remains vacant and Insurance companies don’t like to insure empty houses for extended periods – the insurance rates can spike after several months of vacancy. The personal representative should maintain the homeowner’s insurance on the decedent’s house in case of a fire or accident. If the home is vacant, the PR also needs to beware of maintenance issues. If a pipe breaks, significant damage can be done before anyone discovers it which can happen more often than you think in the cold winter months in New England. Repairs can cost thousands of dollars and delay a property’s sale. Assuming the PR has the Administrative power to deal with the real estate, the PR has a fiduciary responsibility to the heirs. If the property drops in value, during the time improvements are being made or as a result of any potential mistakes made by the PR, they are liable. None of the heirs/devisees will complain if things go well and the property is sold for more than what was expected but you can count on complaints, potential costs or litigation if the opposite is true. According to Paul Brigham, “The duty of a PR in selling real property is to obtain the highest or most advantageous price for the property. The duty exists regardless of the terms of a binding agreement to sell.” If the estate proceeding is contested or the beneficiaries are simply difficult, it is prudent for a Personal Representative to avoid liability by seeking protection from the probate court through a license to sell. Some of the potential issues as a Personal Representative need to be concerned about include: timing, lack of resources, possibility of reduction of value, water damage, lapse of insurance, property value depreciation and violation of fiduciary responsibility. To mitigate liability, selling sooner rather than later may be the best option. Other things a PR may be responsible for: paying taxes, mortgage, insurance, condo fees, utilities, yard maintenance, snow removal etc. It is probably a good idea to cancel or terminate unnecessary services (e.g., cell phone, landline, cable, etc.) To help avoid tension and family disputes after death it is best to properly plan your estate. With a little planning you can leave a legacy that helps your loved ones carry out your wishes and make it easier and faster to sell your home after death. Part of this planning should include that heirs know where all the estate and other important documents (homeowner’s policy, life insurance, bank and investment account numbers) are located and they should also have a copy of them. In an upcoming blog I will discuss how to sell real estate from an estate when proper estate planning has been performed and how to properly plan an estate. This article will include recommendations, costs and how to go about simplifying the process of selling real estate post death.

Paul L. Brigham, an attorney and accountant, has over 30 years specializing in the areas of tax, trust and estate administration. Mr. Brigham is currently a member of the Probate, Real Estate and Tax committees of the Massachusetts Bar Association, a member of the Boston Estate Planning Council, a member of the Society of Trust and Estate Practitioners, and a member of the Real Estate Bar Association for Massachusetts. He can be reached at 508-628-3500.

0 Comments

How to sell estate property in Massachusetts - A guide to help you through the process

People, including heirs, often ask me what they need to do to sell the real estate that they have inherited after their parents have passed. It’s an emotional time, making the logistics of estate management, determining what to do, or how to sell the home seem daunting. Often the heirs, beneficiaries and the Personal Representative (PR) of the decedent’s estate are left with multiple questions regarding:

The process of selling an inherited home is confusing enough in Massachusetts, but changes to the law in 2012 have made matters worse. I will help answer these questions and I will tackle the basics of what needs to take place to sell real estate after a decedent’s death in both intestate (without a will) and testate (with a will). These blogs may help guide you, but cannot replace the expertise of a knowledgeable REALTOR, estate attorney, and a CPA with experience in this realm. I have been fortunate to have worked with and be able to interview an expert Estate Planning Attorney, Paul Brigham of Brigham & LaMountain, located in Framingham, MA. In our discussion about the complexity of estate liquidation, he said something that rings true, “The types of probate we initiate now have changed from what they were before - there are different levels of complexity, different levels of court involvement – even if you speak to people at court , most people don’t know what form is supposed to be filed.” This speaks volumes about how difficult it can be to sell real estate as part of an estate resolution, but I will break it down to help heirs and Personal Representatives have a better understanding of the process.

What if the decedent didn’t have a valid will?

If the decedent died without a will the petitioner may represent the estate as intestate. The general rule is that process must be commenced (i.e. “filed”) within 3 years of a decedent’s death. In this case, the title of the real estate transfers automatically to the heirs of the decedent. Heirs at law are those individuals who are entitled by statute to the decedent’s property when there is no will or when the will does not dispose of all assets. Form, MPC 162, must be completed, often by an heir, to identify a decedent’s surviving spouse, children and heirs at law as of the date of the decedent’s death. When there is no will, the court may be petitioned by creditors, friends, or family to initiate the Probate Process and to appoint a Personal Representative (PR). There are legal steps taken to accomplish this and the amount of time depends on the complexity of the estate. Smaller estates can take weeks to months and bigger, more complicated estates can take several months to a year – that is, if there are no objections. Once appointed, the PR only has the authority to sell real estate for the purpose of paying debts (i.e., the mortgage). Otherwise, the heirs of the estate must decide how and when to sell the real estate. Practically speaking there is a time that no one is in charge – legally. Lineal decedents of the deceased are the primary heirs of the estate but a PR is not appointed until the court has been petitioned. If there is only one heir, that person is likely to be appointed the PR and the process usually takes 30-90 days after the petition is filed. Typically, someone steps up and takes responsibility for the real estate while the legal end of it is worked out. After all, someone should confirm that the home is secure, that the heat is on, or that the property has been winterized to prevent any damage to the property during the colder months. It is important to note that during this time, the only evidence of the new owner(s) is sitting in the registry of probate. There is no record at the registry of deeds as to the current ownership; the decedent’s name remains. A deed of distribution gets recorded and the PR files an acknowledgement as to who the heirs are but a probate court makes a final determination in a formal proceeding. Unfortunately there are differing forms of probate administration and again, this is why I recommend the use of an experienced estate attorney. Whether under the formal or informal process the court must be petitioned for a license to sell real estate after there is an offer pending from a potential buyer. The agreed purchase price is an essential element for the license to be granted and the license is granted for a fixed period of time, but usually sufficient to conduct the sale of real estate. It is best if the heirs and the PR are able to come to a consensus as to how to handle the disposition of the real estate. If there is no consensus by the heirs, the PR (or another petitioner), may be forced to seek probate-court assistance to sell real estate from the estate. When the property has an accepted offer, a Notice of Proposed Action is mailed to all heirs, simply stating the terms of the proposed sale. The heirs have 15 days to review the notice and pose any objections. If there are no objections, the sale may proceed without a court hearing.

What happens if the decedent has a valid will?

If the decedent died with a will and the petitioner is offering the decedent’s last will for probate, the petitioner may represent the estate as testate. The petitioner must state on the Petition:

In a will, there is usually a nomination of who is going to be the Personal Representative (PR) and who is going to receive the real estate, known as heirs or devisees. The will may grant the PR the authority to sell the real estate – if so, the PR does not need to petition the court for a license to sell the real estate. Who are Devisees? Devisees are persons, entities, charitable organizations, or trusts designated in a will to receive the Decedent's personal or real property. In the case of a devise to an existing trust or trustee, or to a trustee or trust established by the will, the trust or trustee is the devise. The beneficiaries are NOT devisees. For all cases (informal and formal) seeking to probate a will, Form MPC 163 must be completed to identify a decedent’s devisees.

Learn more about the MUPC: MUPC Administration Procedural Guide Second Addition In my upcoming blog, Recommendations for Selling an Inherited Home, I discuss the distribution of personal property, recommendations for selling inherited homes in Massachusetts, whether or not you can make improvements to the home before sale, how to sell the home quickly, and the risks and pitfalls of selling an inherited home.

Paul L. Brigham, an attorney and accountant, has over 30 years specializing in the areas of tax, trust and estate administration and financial consultation. His clients include numerous multi-generational family relationships and closely-held business owners in the New England region. Mr. Brigham is currently a member of the Probate, Real Estate and Tax committees of the Massachusetts Bar Association, a member of the Boston Estate Planning Council, a member of the Society of Trust and Estate Practitioners, and a member of the Real Estate Bar Association for Massachusetts. He can be reached at 508-628-3500.

John Agostinelli is the co-author of Easy Money and the American Real Estate Ponzi Scheme, and is a recognized authority in real estate. John is a real estate investor, broker, industry consultant and housing policy commentator. His market focus is the Boston MetroWest area.

He services: Ashland, Dover, Framingham, Holliston, Hopkinton, Marlborough, Medfield, Medway, Milford, Millis, Natick, Northborough, Sherborn, Southborough, Sudbury, Wayland, Westborough, Upton John has helped hundreds of investors, buyers and sellers, sell, purchase or invest in real estate in over 50 Massachusetts towns. Please contact him via email at john@agostinelli.com or by phone at 508-283-4958. Other helpful articles/books worth reading: http://www.easymoneyinamerica.com/ https://bostonagentmagazine.com/2015/01/19/the-short-list-john-agostinellis-tips-for-understanding-todays-financing-landscape/ http://www.gmnews.com/2016/08/11/housing-peaks-and-valleys/ https://www.amazon.com/Money-American-Estate-Ponzi-Scheme/dp/1633933334

A quick examination of its origin and where we are today...

I am often asked whether or not I believe the American Dream is dead or alive. The answer is a little more complex than you might expect, but I believe it is alive and well as long as you understand the original tenets of the dream. We all have our own personal view of what the American Dream means, but today it has quite a different connotation from when the term was first coined. It has been altered to align with the culture of the time and has been manipulated by politicians for decades with a promise of prosperity. Most recently, the American Dream has been connected to the pursuit of material prosperity, becoming wealthy or striking it rich. The concept of it began prior to the Revolutionary War, but the term was not coined until a book was written in 1931 by James Truslow Adams titled, The Epic of America...

The American Dream has been the national creed and the product of the imaginations of its citizens but it used to be based on a passionate devotion to great American Ideals; Every citizen should have an equal opportunity of liberty, freedom, individualism achieved through hard work, initiative and determination. Today, we live in a society where the mindset is that “everyone deserves a trophy,” and, for many, there is no bigger trophy than a house. By inflaming that penchant for more or bigger is better and subsidizing home ownership with I.O.Us, our own government is killing these ideals. Is The American Dream dead or has the bar simply been set too high? What is going wrong?

Origins of this Ideology

We must first examine the origins of this ideology; it can be traced as far back as Puritans who fled religious persecution in England. “[Their] migration was not like so many earlier ones in history, led by warrior lords with followers dependent on them, but was one in which the common man as well as the leader was hoping for greater freedom and happiness for himself and his children,” Adams said. During ancient Greek and Roman times, man discovered that he prospers best when given the opportunity to choose his own destiny. Many of our European founding fathers who were well versed in classical studies of the time, and having bore the heavy yoke of the monarchy of King George, designed a representative democracy as its government. They recognized that opportunity can be maximized through the freedom of choice. The American experiment in democracy allowed each citizen the chance to seize opportunity based on one's own abilities and industry. 240 years since the Declaration of Independence, America is still the ideal to emulate for much of the world, and it is why so many still seek to come here. Prior to our forefathers immigrating to the United States, ownership of land was subject to the king's favor and serfdom and was prevalent in Eastern Europe. The American Dream has come to be known as many things, not the least of which is the right to own land and a home. But the ideal of the dream has changed. The elements of liberty, freedom and self-determination were integral parts of this country’s founding. The Declaration of Independence further expounded this ideology and proclaims that “all men are created equal . . . with certain unalienable Rights” and holds significant meaning in that all people have an equal opportunity to achieve, “Life, Liberty and the pursuit of Happiness.” This is what differentiates us from other countries and the result is American exceptionalism. The roots of home ownership are based in the right of people to own their own land and property, with all the benefits and responsibilities that it entails. The federal government encouraged that sentiment through the Homestead Act of 1862, which offered free federal land to those who would till it and build homes on it. Even before the 1920’s the U.S. Department of Labor’s “Own Your Own Home” program was promoted by passing out “we own our own home” buttons to school children, sponsoring lectures on the topic at universities and distributed posters and banners extolling the virtues of homeownership. Before this point there was no link between the government’s push for homeownership and the American Dream—it was simply understood that this was something free people could pursue. Adams spoke of the American Dream as “…a better, richer, and happier life for all our citizens of every rank.” But it is clear that Adams was not referring to the excessive consumerism we see today, “that dream of a land in which life should be better and richer and fuller for every man, with opportunity for each according to his ability or achievement.” This is indicative of the mindset of the time; it is still an attainable outcome for those with ability and the desire to work hard. Today, there is a disconnect between the meanings and the words, between what we say and what we do—this very disconnect from reality goes beyond the intangible and philosophical. It is destroying more than spirit. It is literally destroying the wealth and capital it took centuries of liberty and free trade to build. I had a front row seat to this phenomenon as a speculation home builder and real estate broker leading up to the Great Recession. In addition, my co-author and I have spent years researching these themes for our upcoming book Easy Money and the American Real Estate Ponzi Scheme, to be published in December of 2016. After World War II, subdivisions were being constructed across the nation, but the homes built were rather utilitarian compared to today’s standards. Many of the new homes built back then included only two bedrooms, one bathroom and were situated on relatively small lots. Most of these homes were modest and did not have basements or garages. Over the years and through government encouragement, home ownership has been distorted from being a symbol of reward and achievement to one of being treated more like a right. Government housing programs have become enablers to marginal aspirants of this dream. The Real Estate Industrial Complex, which consists of The National Association of Realtors, the National Association of Home Builders, and the American Bankers Association – to name a few, ever hungry for profits have become the facilitators. Some believe the best way to arrive at this destination and the ability to achieve almost anything is through hard work with some willing to work more hours to obtain nicer cars and bigger homes yet have less time to enjoy them. For others it is more about the freedom of spirituality and living a simple and contented life or that a college degree is a path to the American Dream. But, there are an increasing number of people that believe hard work and determination may not be enough, after all there is no guarantee. Have we become a nation of spoiled children? Have we shorn our values, morals and cohesiveness as a culture for the quick fix, immediate gratification and short-term thinking? At times, we pander to the lowest common denominator and call it compassion. It's no wonder the world looks at our culture as one of excess and privilege. In relation to much of the world, we are privileged. We are diverse and have vast human and material resources at our disposal, and yet we consider the smallest obstacles, requirements or standards to be “oppressive.” Maybe we need to re-examine our culture of extremism and denial. Our founding fathers did not envision the kind of culture that blames one's shortcomings on the controlling influence of others or of perceived persecution. Some have argued that upward mobility and financial security is alive and well but for only the most-wealthy of Americans and that low to moderate income Americans have never felt less secure, financially, than they do today. The blame game for those who feel that the American Dream is not attainable is often vague. They often cite politicians or the one percenters for their failings. Others blame immigrants for stealing jobs or creating competition and pushing wages down. Many of these immigrants have seen their freedom and wealth grow by crossing the border, their optimism abounds and the American Dream becomes reality. Have we as a nation become so entitled that we do not see the opportunity that our forefathers saw and immigrants see so clearly? Downward mobility is not the new normal and upward mobility is not insurmountable. It will take, however, some new thinking, re-setting expectations, delayed gratification and a focus to succeed.

The Dream is Alive

The American Dream is still most certainly attainable if people do not get caught up with one-upping the Jones’ and live comfortably within their means. Many can attain it but the acquisition of material possessions or extent of fame will rightfully be varied according to the value society places on the fruit of their labor. Otherwise, equal outcomes will reduce what has made this country special. Equal outcomes that are legislated by the well intentioned will diminish personal incentive and will eventually lead to a lower standard of living for all. It’s ironic that those who seek their perception of fair share and equality through their political allies and media proponents wish to do so at the expense of others, while claiming everyone but themselves is greedy. We need to return to our original values and turn away from the greed aspect that has been legitimized into its modern day interpretation. We have gone from the perception of deserving the right to pursue success to the idea that it should be guaranteed. When do we recognize that enough is enough? It is sacrilegious to say that the next generation does not need to have a higher standard of living than the previous generation. We should dispose of unattainable goals and expectations because we can no longer borrow our way into a new and better American Dream as our $19.5 trillion National Debt attests. To attain our ever-increasing expectations, requires even longer work weeks and deficit spending ad infinitum. Most homeowners today need two incomes to satisfy the escalation of the new perceived American Dream with no room to grow. There are headwinds to be sure, including: The labor force participation rate which is at its lowest levels since the 1970’s, the pains of self inflicted debt at both the personal and national level, the weakest economic recovery since the Great Depression and restrictive zoning laws (if we want to alleviate the shortage and affordability issues of real estate.) But for the most part, people are now able to live as they like both in social and financial terms. People have the ability to change their station in life and the American Dream is alive and well for those willing to sacrifice a little and focus on the original tenets of great American ideals. To accomplish this goal it is clearly important to reject consumerism, focus on thrift and reinstituting saving and investing like our parents’ generation. Finally the recent growth in wages is sure to help. Don’t listen to the noise, pessimism sells, but those who want it can certainly still achieve the American Dream.

John Agostinelli is the co-author of Easy Money and the American Real Estate Ponzi Schemewww.amazon.com/Money-American-Estate-Ponzi-Scheme/dp/1633933334, and is a recognized authority in real estate. John is a real estate investor, broker, industry consultant and housing policy commentator. His market focus is the Boston MetroWest area.

He services: Ashland, Dover, Framingham, Holliston, Hopkinton, Marlborough, Medfield, Medway, Milford, Millis, Natick, Northborough, Sherborn, Southborough, Sudbury, Wayland, Westborough, Upton John has helped hundreds of investors, buyers and sellers, sell, purchase or invest in real estate in over 50 Massachusetts towns. Please contact him via email at john@agostinelli.com or by phone at 508-283-4958. Other helpful articles/books worth reading: http://www.easymoneyinamerica.com/ https://bostonagentmagazine.com/2015/01/19/the-short-list-john-agostinellis-tips-for-understanding-todays-financing-landscape/ http://www.gmnews.com/2016/08/11/housing-peaks-and-valleys/ https://www.amazon.com/Money-American-Estate-Ponzi-Scheme/dp/1633933334

John Agostinelli, along with his co-author, Chris Michaud, were interviewed about their upcoming book “Easy Money and the Great Real Estate Ponzi Scheme” on WCRN “True Talk 830.” We discussed many different housing related issues including mortgages, housing policy, and how they affect the rising housing market. Hear the full interview below:

John Agostinelli is the co-author of Easy Money and the American Real Estate Ponzi Scheme, and is a recognized authority in real estate. John is a real estate investor, broker, industry consultant and housing policy commentator. His market focus is the Boston MetroWest area.

He services: Ashland, Dover, Framingham, Holliston, Hopkinton, Marlborough, Medfield, Medway, Milford, Millis, Natick, Northborough, Sherborn, Southborough, Sudbury, Wayland, Westborough, Upton John has helped hundreds of investors, buyers and sellers, sell, purchase or invest in real estate in over 50 Massachusetts towns. Please contact him via email at john@agostinelli.com or by phone at 508-283-4958. Other helpful articles/books worth reading: http://www.easymoneyinamerica.com/ https://bostonagentmagazine.com/2015/01/19/the-short-list-john-agostinellis-tips-for-understanding-todays-financing-landscape/ http://www.gmnews.com/2016/08/11/housing-peaks-and-valleys/

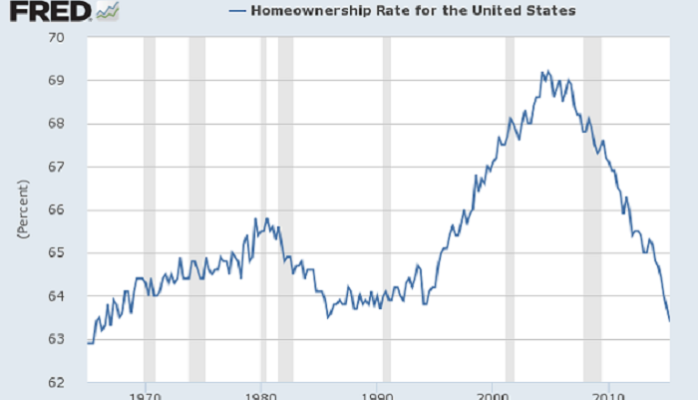

Let's begin with a quick explanation of how we got here. For the past 50 years, housing policy has relied on looser underwriting standards in an effort to increase homeownership and help the economy. Much of that lending has been targeted to low- and moderate-income homebuyers in an attempt to build wealth for these households. That agenda has pushed a reliance on high leverage, long amortization schedules (30-year loan terms), low down payments and high debt to income (DTI) ratios. In addition, these loans are often made to borrowers with impaired credit. That approach may have increased homeownership rates in the short term, but many homeowners could not handle their payments, and we are now seeing homeownership rates return to pre 1970 levels in the low-60-percent range. The push towards homeownership has neither increased the rates over the long haul, nor has it reliably created wealth.

After this push failed and the Great Depression took hold, lawmakers Barney Frank and Chris Dodd championed new legislation, called the Dodd-Frank Act (DFA), to prevent another financial debacle. The DFA greatly expands oversight and regulation of the financial institutions not seen since the Great Depression, and includes three criteria for housing finance reform: first, a high quality mortgage— called the Qualified Residential Mortgage (QRM)—that would have a minimal incidence of default; second, a set of minimum mortgage standards called the Qualified Mortgage (QM); and third, a requirement that the securitizer of any mortgage not a QRM retain at least 5 percent of the risk of any mortgage pool it sponsors. Unfortunately, politicians exerted their influence in defining QRM, which has resulted in a watered down version that only meets the minimum requirements of QM; in other words, the lending standards are looser and less safe than originally intended.

The National Association of Realtors and the general media have reported that the mortgage market is tight, and the Federal Reserve Chair, Janet Yellen, has stated that only people with pristine credit can get financing; neither statements are accurate. According to the American Enterprise Institute, there has been little discernible volume impact from the Qualified Mortgage regulation. Over the past three months, the DTI ratios are high, and a significant number of them were greater than 43 percent. Currently, the number of Fannie and Freddie loans that have total DTIs greater than 38 percent is more than double what they were in 1990. The Federal Housing Administration (FHA) has a sizable share of loans with DTIs over 50 percent, which is an extremely high pre-tax payment burden. That makes it difficult to pay income tax, commuting expenses, living expenses and food with what is left. The VA’s residual-income underwriting is a key to limiting defaults, and it’s unfortunate that Fannie Mae, Freddie Mac and the FHA do not look at this less risky method of analyzing ability to repay. The softness in mortgage lending is not due to tight standards, but to reduced affordability, loan put-back risk (part of DFA) and the sluggish economic recovery. The truth of the matter is that this recovery has had limited gains in income, and with an unequal distribution. It appears that our memories are short, and the financial lessons learned from the recent financial debacle are fading with the GSEs officially re-entering into the 97 percent LTV market. Currently, more than half of all purchase loans have a down payment of 5 percent or less. Under the original QRM proposed standards, borrowers would have been required to put 20 percent down. However, as noted above, that proposed standard disappeared under political pressure, as politicians and the real estate industrial complex have continued to push for looser lending standards – which, with an expanding credit box, will result in higher defaults. Even if a buyer can obtain financing, they should examine their true ability to repay, and may want to leave enough money to contribute to retirement plans and saving for their children’s education. Just because a lender will lend, does not mean that it is in the best long-term interest of the buyer. As a matter of fact, higher debt to income (DTI) ratios limit participation in defined contribution retirement plans such as 401(k)s, most of which come with employer matching contributions. Furthermore, having a high DTI often leads to insufficient income to meet the requirements of the mortgage, living costs and saving for the future. A 401(K) plan can be a reliable and attractive means for private wealth accumulation, particularly for the very groups that were the target of the increase in homeownership. Keeping the DTI to more affordable levels will allow for the unexpected household expenses that we all experience, and make it more likely to weather other financial upsets (such as losing a job).

John Agostinelli is the co-author of Easy Money and the American Real Estate Ponzi Scheme, and is a recognized authority in real estate. John is a real estate investor, broker, industry consultant and housing policy commentator. His market focus is the Boston MetroWest area.

He services: Ashland, Dover, Framingham, Holliston, Hopkinton, Marlborough, Medfield, Medway, Milford, Millis, Natick, Northborough, Sherborn, Southborough, Sudbury, Wayland, Westborough, Upton John has helped hundreds of investors, buyers and sellers, sell, purchase or invest in real estate in over 50 Massachusetts towns. Please contact him via email at john@agostinelli.com or by phone at 508-283-4958. Other helpful articles/books worth reading: http://www.easymoneyinamerica.com/ https://bostonagentmagazine.com/2015/01/19/the-short-list-john-agostinellis-tips-for-understanding-todays-financing-landscape/ http://www.gmnews.com/2016/08/11/housing-peaks-and-valleys/ |